COVID-19 saw the financial system playing a key role as an economic shock absorber. It has also acted as the main tool of economic sanctions policies during the war in Ukraine. The financial system and Financial Services firms are also currently at the forefront of promoting net-zero policies and strategies. The system is clearly resilient and in “better shape than at any time in recent memory to manage and continue to support economic growth”. However, according to Oliver Wyman’s State of Financial Services 2022 report, ‘The Tectonic Shift Between Risk, Data, and Technology’, the resultant growth and value creation taking place is anything but stable.

Although the gender wage gap is beginning to close, there are still huge disparities between men and women’s pay within the UK. Statistics show that, in the UK, women still dominate part-time employment, have the largest share in unpaid labour, and are scarce in the top percentiles of the UK income distribution. The Women and Equalities Select Committee also reported that there has been an unequal economic impact of the COVID-19 pandemic on women. However, the true impact of the pandemic is not yet known due to a pause in wage gap reporting, and some statistics being based on estimations.

The Financial Services industry is undergoing a dramatic shift, with the main driver being slower growth of “more capital-intensive risk intermediation services” relative to the faster growth of more “capital-light services linked to connected data services and value technology services”, which are growing 7% more globally per year.

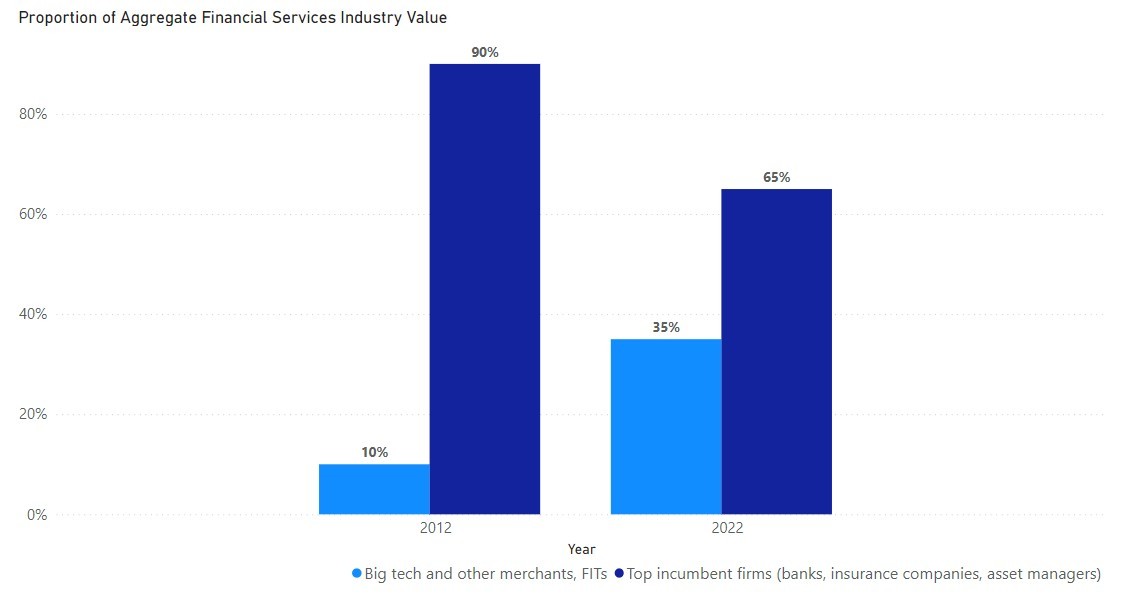

“Incumbent players” such as banks, insurance companies, and asset managers have shrunk as a proportion of the total from 90% of the industry value 10 years ago to about 65% of the industry value today. In comparison, big tech, Financial Infrastructure and Technology firms (FITs), and other merchants active in Financial Services now account for 35% of the aggregate Financial Services industry value.

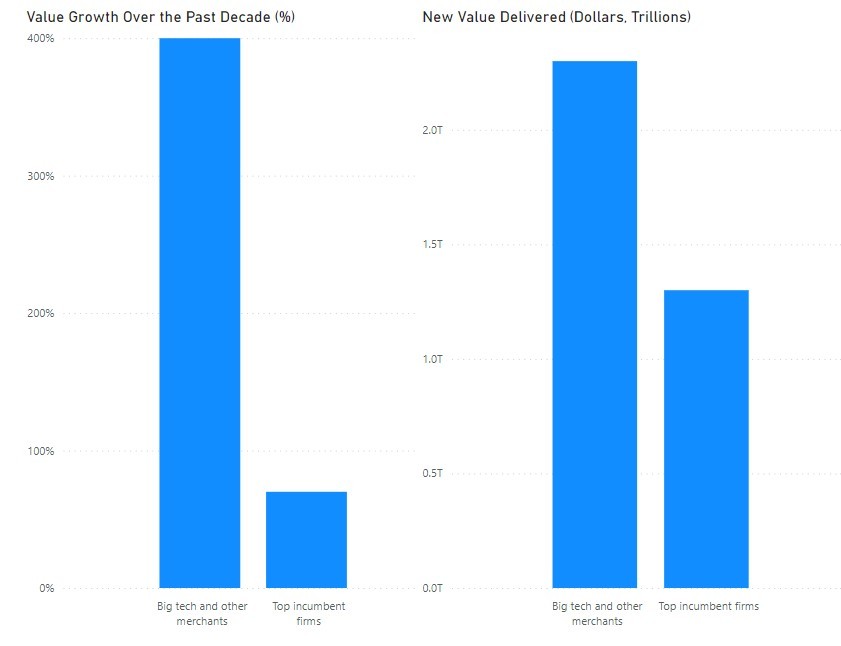

Oliver Wyman also estimates that the top ‘incumbent firms’ have increased their market value by 70% over the past decade, delivering $1.3tn in new value, while big tech, FITs, and other merchants have delivered a huge 400% value growth and nearly $2.3tn of value.

The sector is seeing quite a dramatic and ongoing transition away from legacy, ‘incumbent’ players to digitally-minded, data-driven ways of working, which is putting serious pressure on the status quo. Where do we see Financial Services heading? ‘Industry change is not always gradual,’ the Oliver Wyman report says in its concluding section, an accurate take on the next few years of the industry’s lifetime. Next financial year, we will most likely get even more data to predict the impact of technology on Financial Services, a ubiquitous and, at the moment, unsteadily growing sector.